Forex 80 win

Expert Charts, Trading Tips and Technical Analysis from INO. September 10, by Kenny.

I'll get right to it We've all been in this situation, where we look for a great methodology for our trading style, look at published winning percentages, and then cry when it completely blows up your account In Bill's new article he helps you figure out the solutions.

While doing research on the current state of the Forex trading landscape, I discovered something surprising. Losing Forex traders appear to be enamored with 'winning percentages' when selecting a forex trading method.

The irony in that statement should be obvious -- if the 'winning percentage' of the forex method is so important, how can these traders still be net losers? Because, I believe, winning percentage is the wrong concept to focus on. And, they also have one more 'secret' that losing traders DON'T have. The difference will probably surprise you - and it's a big difference, too.

The answer should have been obvious, but it isn't for most traders. Ask yourself this question: But when their systems 'lose'? They wipe out all of the gains and a good percentage of the trader's account balance, too. See, what most traders don't get is that the reward to risk ratio in those high win percentage methods is upside down.

Traders are risking way too much capital for way too little profit potential. That's poor risk management and can easily lead to one becoming a 'losing' trader.

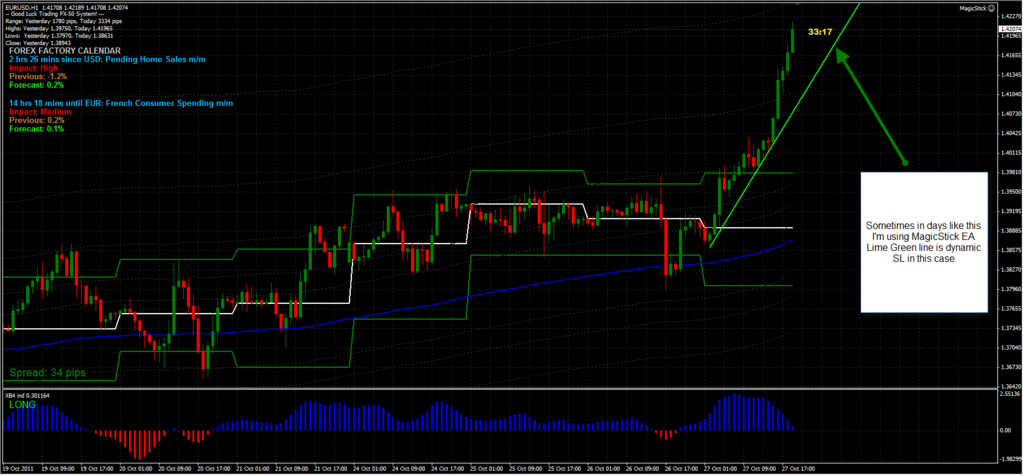

They set stop losses that are far too wide given the reward ratio. We haven't factored in lot or position size yet, either. I would expect it to be a given that the trader above is taking on far too much risk. Keep in mind, too, that trading with an automated or robot method, you are unlikely to be able to stop that 80 pip loss unless you happen to be watching it unfold.

What the 'winning' trader does is eliminate risk as quickly as possible, thereby ensuring infinite reward until they liquidate their position. To do this, these traders take aggressive action to move their initial stop losses up to the break even point from the outset of a trade, set an initial profit target and, once they are able to eliminate the risk side in the trade, they will manage the profit side of the trade by scaling out in stages at predetermined profit points.

In this way, once the trader has been able to 'erase' the risk side, they can focus solely on the profit side - with the worst case scenario being a 'zero' gain trade or, break even.

Now you may not be able to eliminate risk in every single trade; but breaking even on just 1 in every 5 trades can have a significant and positive impact on your account balance. So, don't let yourself be fixated on the 'winning' percentage of a trading method. As you've just seen, that doesn't guarantee you can be a net winner.

Instead, put risk first and profit second. I think you'll be surprised at the results.

Larry Connors RSI-2 Trading System!!! Surprising Win Rate!!! — CELGENE CORP (NASDAQ:CELG) / — ChrisMoody | TradingView

For more examples of how to eliminate risk in your Forex trades, I invite you to watch a recent video series Bill did on 'erasing risk'. Guest Bloggers Tagged With: September 12, at The media associated with trading is also largely to blame for the unrealistic expectations many traders seem to have about perceived gains from trading. Unfortunately the truth is that anything in life that yields great reward comes with a commensurate amount of risk with a huge effort.

Always beware of anything that purports to enable easy, effortless profits such as the "forex robots" or the "internet marketing" or trading or whatever. Truly a losing proposition. The point is that learning to trade with consistent winning results is going to be the hardest thing anyone has ever done.

The reason is that it involves learning total self-control and most people do not have what it takes to achieve that. September 12, at 7: The marketing behind "robots" is something else. Web is just loaded with them, much more than any previous "wonder" systems. An average new comer can easily be overtaken by the hype. Very good point that becoming consistent trader is not easy. It takes patience and discipline, over time.

It can be simple, but not easy. This leads you to what your maximum drawdown will likely be. This makes the drawdown easier and the losing streaks easier to bear.

However, key to success with any method is to back test and forward test your method and assess these figures yourself. Then YOU know what your expectations can reasonably be and can plan your trading accordingly. Unrealistic expectations i what kills most small traders.

They have a few huundred or thousand dollars and expect to spend five minutes a day trading to provide a luxurious income while they sit on the beach most of the daty.

September 11, at 7: That is the secret. An example of haow a "small" trader could manage risk with a small account is to base the risk of a trade on a faster time frame for an objective on a longer time frame.

Forex Broker InstaForex: le trading sur le marché des changes.

Another aspect of risk control which Mark Douglas aptly delves into is the concept of REALLY ACCEPTING THE RISK on a trade. I have found this is enhanced greatly by trading price action tests instead of breakouts. With an awareness of the fact that any given bar has a probability of making some range associated with it.

These probabilities are very very important. Say for instance a trader is going to put on a trade on the russell mini and the 15m bar that finishes at has 5.

Well the 3-bar range might be 2. It could, BUT the most probable equity available on this trade is already past! This would be trading the long-tail distribution on the downhill side What I am getting at is using probabilities to enhance a trader's risk-acceptance ability.

Also helps to prevent overtrading and simulates trading the way the "big" traders do it. Put your winning percentage in line with the probabilities and confidence with consistency is enabled. September 10, at Good article, thank you Everybody talks about reward and only the serious and successful traders think about risk. Everybody wants to make money trading but few spend the time and effort to build a strong base on their money and trade management rules to manage the risk side of the equation.

These tell you tons more about your trading system than a mere win percentage - Great article, and again thanks for pointing this crucial element out.

September 10, at 3: Arbitrarily moving stops around to "Eliminate Risk" sounds risky.

Maybe it sounds good when your retail trading experience has you running and confused as to what will happen next. The truth is,, "It is too good to be true!! I have moved stops to be stopped out and then see the expansion run 80 points after I'm out.

They hunted me and Killed me. Sometimes lucky, but mostly Hammered. You have sold me "NOT" to buy any Robots!!! Most people like to think of themselves as risk takers, but what they really want is a guaranteed outcome with a little bit of suspense.

Forex Daily Scalper: Main Page

We all know this is impossible. Instead, one needs to quantify the risk and then change their mindset so that they truly learn to accept the risk. This may be the risk of losing money, the risk of being wrong which can lead to criticism from colleagues or clients, or the risk of missing moves by either entering late or exiting early which could lead to a different type of angst all together. Only when we can truly accept all the risks involved in trading, we will become better traders.

It happens to me all the time, is nice video about it and i'm trying to practice and still have loosing trades. It is very true, perecntage of winning trades ia not everything.

Forex 80 win

Total result, as expressesed in net account gain, over time is more important. However, given two different strategies, both of them being profitable, majority of people will likely choose one that has more winners. From psychological view, most of us want to be right more often than wrong. Never mind that in this scenario an average loosing trade will be bigger. Traders have to decide for themselves if they want more smaller losses or fewer bigger once.

Of course, a winning strategy must be in place first in order to make money at all.

September 10, at 8: Pulse Markets Futures Stocks Forex World Indices Metals Exchanges Charts Symbol List Extremes Portfolio News Headline News Commentary MarketClub Join Now Top Stocks Top ETFs Top Penny Stocks Top Forex Trend Analysis Videos Market Analysis Email Services Blog Free.

Wednesday Jun 21st, 6: Comments Keith Carr says September 12, at I'm a Loser and Proud of it. Why not always move your stop and always let the market knock you out? Recent Posts Is Amazon Threatening CVS Health?

Time's Up Janet From Another Planet Weekly Futures Recap With Mike Seery Another Big Cyber-Security Hack, When Should You Buy The HACK ETF. Trader Comments Ken on The Gold Clone: Time's Up Les on The Gold Clone: Time's Up Graham on The Gold Clone: Time's Up Frederick on Why The U.

Gasoline Stock Build Was Not Surprising andy resetar on Janet From Another Planet. Categories General Guest Bloggers INO Cares INO. Blogroll 4 Futures Newsletter Add Your Blog Here Biiwii TA and Commentary Crude Oil Trader ETF Daily News Feed The Bull Learn Options Trading Online Stock Trading Guide Options Trading Mastery Scott's Investments Stock Gumshoe Traders Day Trading Vantage Point Trading VantagePoint Trading Software.