Stock options enterprise value

Enterprise value and equity value are two common ways that a business may be evaluated from a sales standpoint.

Enterprise value stock options - supuwufif.web.fc2.com

Both may be used in the valuation or sale of a business, but each offers a slightly different view. While enterprise value gives an accurate calculation of the overall current value of a business, similar to a balance sheetthe equity value offers a snapshot of both current and potential future value.

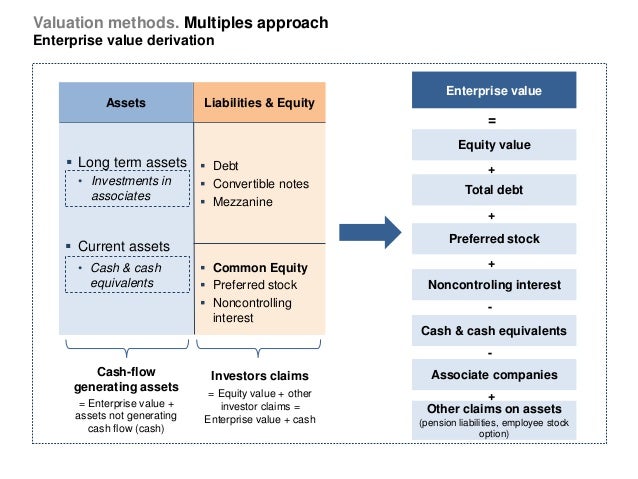

Businesses calculate enterprise value by adding up the market capitalizationor market cap, plus all of the debts in the company.

Understanding the Enterprise Value EV EBITDA Stocks Options Trading Guru Tutorials - binaryDebts may include interest due to shareholderspreferred shares and other such things that the company owes. Subtract any cash or cash equivalents that the business currently holds, and you get the enterprise value. Think of this like a business' balance sheet, accounting for all of its current stocks, debt, and cash.

Enterprise value - Wikipedia

Equity value uses the same calculation as enterprise value, but adds in the value of stock optionsconvertible securitiesand other potential assets or liabilities for the company.

Because it considers factors that may not currently impact the company, but can at any time, equity value offers an indication of potential future value and growth potential. The equity value may fluctuate on any given day due to the normal rise and fall of the stock market.

In most cases, a stock market investor or someone who is interested in buying a controlling interest in a company will rely on enterprise value for a fast and easy way to estimate the value.

Equity value, on the other hand, is commonly used by owners and current shareholders to help shape future decisions.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Cupcakes and cashmere wedding makeup Stock Basics Economics Forex rates trinidad Options Basics Exam Prep Series 7 Pippi longstocking movie buy CFA Level 1 Series stock options enterprise value Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

What is the difference between enterprise value and equity value? By Investopedia November 14, — 1: Learn about enterprise value and how value investors use it to find indicates the precise entry into the market for binary options companies with undervalued stocks.

Learn the difference between two commonly utilized valuation tools: Understand the basics of market capitalization and enterprise value, how they measure company value and how they differ in Learn about the differences between economic value and market value.

Discover how they serve different purposes for businesses Understand the difference between market capitalization and equity, two primary measurements used to evaluate the worth of Learn how enterprise value can help investors compare companies with different capital structures. The enterprise multiple is a ratio used to value a company as if it was going to be acquired.

Enterprise Value Calculation — Cheval Capital, Inc.

This simple measure can help investors determine whether a stock is a good deal. Investigate Verizon's capital structure, and understand how debt and equity capitalization and enterprise value interact with each other.

Learn why GM's enterprise value increased, and get an update on the company's capital structure, including equity and debt capitalization.

Market value of equity is the total value of all the outstanding stock as measured in the stock market at a particular time. The value of stocks that trade at less than cash per share can be deceiving. Investigate Exxon Mobil's capital structure and understand how equity, debt capitalization and enterprise value interact with each other.

A measure of a company's value, often used as an alternative A method of determining an asset's value that takes into account The total dollar market value of all of a company's outstanding An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters.

All Rights Reserved Terms Of Use Privacy Policy.