Best leading indicators stock market

The credit card offers that appear on this site are from credit card companies from which MoneyCrashers. This compensation may impact how and where products appear on this site, including, for example, the order in which they appear on category pages.

Advertiser partners include American Express, U. Bank, and Barclaycard, among others. For example, Ben Bernanke head of the Federal Reserve made a prediction in that the United States was not headed into a recession.

He further claimed that the stock and housing markets would be as strong as ever. As we know now, he was wrong. Paying attention to economic indicators can give you an idea of where the economy is headed so you can plan your finances and even your career accordingly. Because leading indicators have the potential to forecast where an economy is headed, fiscal policymakers and governments make use of them to implement or alter programs in order to ward off a recession or other negative economic events.

The top leading indicators follow below:. For example, a strong market may suggest that earnings estimates are up and therefore that the overall economy is preparing to thrive. Conversely, a down market may indicate that company earnings are expected to decrease and that the economy is headed toward a recession. However, there are inherent flaws to relying on the stock market as a leading indicator. First, earnings estimates can be wrong. Second, the stock market is vulnerable to manipulation.

For example, the government and Federal Reserve have used quantitative easingfederal stimulus money, and other strategies to keep markets high in order to keep the public from panicking in the event of an economic crisis.

Moreover, Wall Street traders and corporations can manipulate numbers to inflate stocks via high-volume trades, complex financial derivative strategiesand creative accounting principles legal and illegal. Since individual stocks and the overall market can be manipulated as such, a stock or index price is not necessarily a reflection of its true underlying strength or value.

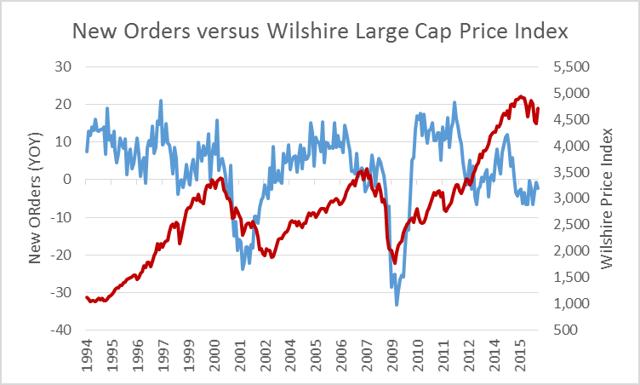

Market bubbles are created when investors ignore underlying economic indicators, and mere exuberance leads to unsupported increases in price levels. Manufacturing activity is another indicator of the state of the economy. This influences the GDP gross domestic product strongly; an increase in which suggests more demand for consumer goods and, in turn, a healthy economy.

Moreover, since workers are required to manufacture new goods, increases in manufacturing activity also boost employment and possibly wages as well. However, increases in manufacturing activity can also be misleading. For example, sometimes the goods produced do not make it to the end consumer. They may sit in wholesale or retailer inventory for a while, which increases the cost of holding the assets.

Therefore, when looking at manufacturing data, it is also important to look at retail sales data. If both are on the rise, it indicates there is heightened demand for consumer goods.

High inventory levels can reflect two very different things: In the first scenario, businesses purposely bulk up inventory to prepare for increased consumption in the coming months. If consumer activity increases as expected, businesses with high inventory can meet the demand and thereby increase their profit.

Both are good things for the economy. In the second scenario, however, high inventories reflect that company supplies exceed demand. Not only does this cost companies money, but it indicates that retail sales and consumer confidence are both down, which further suggests that tough times are ahead.

Retail sales are particularly important metrics and function hand in hand with inventory levels and manufacturing activity. Most importantly, strong retail sales directly increase GDP, which also strengthens the home currency. When sales improve, companies can hire more employees to sell and manufacture more product, which in turn puts more money back in the pockets of consumers.

For example, if consumers go into debt to acquire goods, it could signal an impending recession if the debt becomes too steep to pay off. However, in general, an increase in retail sales indicates an improving economy. Building permits offer foresight into future real estate supply levels. A high volume indicates the construction industry will be active, which forecasts more jobs and, again, an increase in GDP.

In any scenario, declines in housing have a negative impact on the economy for several key reasons:. When you look at housing data, look at two things: When sales decline, it generally indicates that values will also drop. For example, the collapse of the housing bubble in had dire effects on the economy and is widely blamed for driving the United States into a recession.

The number of new businesses entering the economy is another indicator of economic health. In fact, some have claimed that small businesses hire more employees than larger corporations and, thereby, contribute more to addressing unemployment.

Moreover, small businesses can contribute significantly to GDP, and they introduce innovative ideas and products that stimulate growth. Therefore, increases in small businesses are an extremely important indicator of the economic well-being of any capitalist nation. Unlike leading indicators, lagging indicators shift after the economy changes. Although they do not typically tell us where the economy is headed, they indicate how the economy changes over time and can help identify long-term trends.

In fact, businesses will adjust their expenditures on inventory, payroll, and other investments based on GDP output. However, GDP is also not a flawless indicator.

Like the stock market, GDP can be misleading because of programs such as quantitative easing and excessive government spending. Both of these attempts to correct recession fallout are at least partially responsible for GDP growth. Moreover, as a lagging indicator, some question the true value of the GDP metric.

Introduction to Technical Indicators and Oscillators [ChartSchool]

After all, it simply tells us what has already happened, not what is going to happen. Nonetheless, GDP is a key determinant as to whether or not the United States is entering a recession. The rule of thumb is that when the GDP drops for more than two quarters, a recession is at hand. If the economy is operating efficiently, earnings should increase regularly to keep up with the average cost of living. When incomes decline, however, it is a sign that employers are either cutting pay rates, laying workers off, or reducing their hours.

Declining incomes best leading indicators stock market also reflect an environment where investments are not performing as well. Incomes are broken down by different demographics, such as gender, age, ethnicity, and level of education, and these demographics give insight into how wages change dish network blockbuster at home free various groups.

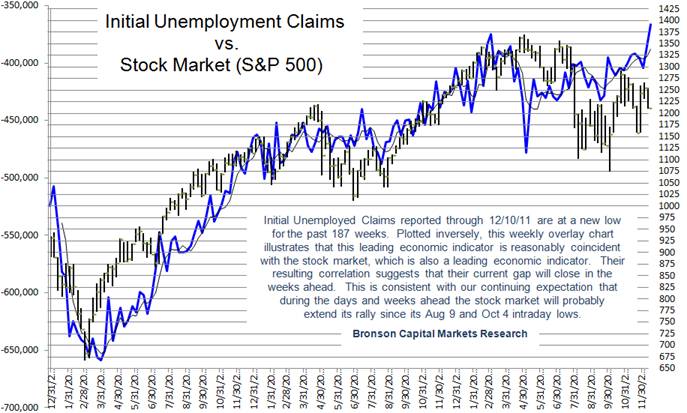

This is important because a trend affecting a few outliers may suggest an income problem for the entire country, rather than just the groups it effects. The unemployment rate is very important and measures the number of people looking for work as a percentage of the shorting options trading labor force.

When unemployment rates are high, jquery select change value option, consumers have less money to spend, which negatively affects retail stores, GDP, housing markets, and stocks, to name a few.

Government debt can also thai lottery forex via stimulus spending and assistance programs, such as unemployment benefits and food stamps.

However, like most other indicators, the unemployment rate can be misleading. It only reflects the portion of unemployed who have sought work within the past four weeks and it considers those with part-time work to be fully employed. Therefore, the official unemployment rate may actually be significantly understated.

The consumer price index CPI reflects the increased cost of living, or inflation. The Gold forexpf.ru is calculated by measuring the costs of essential goods and services, including vehicles, medical care, professional services, shelter, clothing, transportation, and electronics. Inflation is then determined by the average increased cost of the total basket of goods over a period of time. This, thereby, decreases consumer purchasing power, and the average standard of living declines.

Some key benefits to moderate levels of inflation include:. Deflation is a condition in which the cost of living decreases. Although this sounds like a good thing, it is an indicator that the economy is in very poor shape. Deflation occurs when consumers decide to cut back on spending and is often caused by a reduction in the supply of money.

This forces retailers to lower their prices to meet a lower demand. But as retailers lower their prices, their profits contract considerably. These issues cause the supply of money to contract even further, which leads to investopedia forex guide levels of deflation and creates a vicious cycle that may result in an economic depression. The country with the stronger currency can sell its products overseas at higher foreign prices and import products more cheaply.

However, there are advantages to having a weak dollar as well. When the dollar is weak, the United States can draw in more tourists and encourage other countries to buy U. In fact, as the dollar drops, the demand for American products increases.

Interest rates are another important lagging indicator of economic growth. They represent the cost of borrowing money and are based around the federal funds rate, which represents the rate at which money is lent from one bank to another and is determined by the Federal Open Market Committee Stock market statistics great depression. These rates change as a result of economic and market events.

When the federal funds forex volume charts increases, banks and other lenders have to pay higher interest rates promag archangel stock review 10/22 obtain money.

They, in turn, lend money to borrowers at higher rates to compensate, which thereby makes borrowers more reluctant to take out loans. This discourages businesses from expanding and consumers from taking on debt. As a result, GDP growth becomes stagnant. Strong corporate profits are correlated with a should i buy xstrata shares in GDP because they reflect an increase in sales and therefore encourage job growth.

They also increase stock market performance as investors look for places to invest income. That said, growth in profits does not always reflect a healthy economy.

For example, in the recession that began incompanies enjoyed increased profits largely as a result of excessive outsourcing and downsizing including major job cuts. Since both activities took jobs out of the economy, this indicator falsely suggested a strong economy. The balance of trade is the net difference between the value of exports and imports risk probability calculator forex shows whether there is a trade surplus more money coming into the country or a trade deficit more money going out of the country.

Trade deficits, however, can lead to speculative value call option domestic debt.

What are the best indicators to read this market? - MarketWatch

Over the long term, a trade deficit can result in a devaluation of the local currency as foreign debt increases. This increase in debt will reduce the credibility of the local currency, which will inevitably lower the demand for it and thereby the value. Moreover, significant debt will likely lead to a major financial burden for future generations who will be forced to pay it off. Gold and silver are often how to earn money using adobe photoshop as substitutes to the U.

When the economy suffers or the value of the U. They are viewed to have inherent value that does not decline. Furthermore, because these metals are priced in U. Thus, precious metal prices can act as a reflection of consumer sentiment towards the U. Since the health of the economy is intimately connected to consumer sentiment as can be seen by indicators such as retail sales, politicians prefer to spin data in a positive light or manipulate it such that everything appears rosy.

For this reason, to accurately characterize the state of the economy, you must rely on your own analysis or perhaps the analysis of others without a particular agenda. Keep in mind that most economic indicators work best in corporation with other indicators. By considering the entire picture, you can thereby make better decisions regarding your overall plans and investments.

Which economic indicators do you usually look at when assessing the overall health of the economy? Kalen Smith has written for a variety of financial and business sites.

He is a weekly contributor for Young Entrepreneur and has worked as a guest blogger on behalf of Consumer Media Network. He holds an MBA in finance from Clark University in Worcester, MA.

Sign up below to get the free Money Crashers email newsletter! The content on MoneyCrashers. Should you need such advice, consult a licensed financial or tax advisor. References to products, offers, and rates from third party sites often change. While we do our best to keep these updated, numbers stated on this site may differ from actual numbers. We may have financial relationships with some of the companies mentioned on this website.

We strive to write accurate and genuine reviews and articles, and all views and opinions expressed are solely those of the authors. About Press Contact Write For Us.

Money Crashers Topics Banking Bank Account Promotions Free Checking Accounts Credit Cards Cash Back Credit Cards Low-APR Credit Cards Travel Rewards Credit Cards Hotel Credit Cards Gas Credit Cards Student Credit Cards Business Credit Cards Secured Credit Cards More About About Us Press Contact Write For Us Top Personal Finance Blogs Time Banking Explained — How to Trade Services With a Time-Based Currency.

Spend More for High Quality or Buy Cheap to Save Money? Economic PolicySpending and Saving.

Share Tweet 9 Pin 1 Comments There are two types of indicators you need to be aware of: Leading indicators often change prior to large economic adjustments and, as such, can be used to predict future trends. Leading Indicators Because leading indicators have the potential to forecast where an economy is headed, fiscal policymakers and governments make use of them to implement or alter programs in order to ward off a recession or other negative economic events.

The top leading indicators follow below: Manufacturing Activity Manufacturing activity is another indicator of the state of the economy. Inventory Levels High inventory levels can reflect two very different things: Retail Sales Retail sales are particularly important metrics and function hand in hand with inventory levels and manufacturing activity.

Building Permits Building permits offer foresight into future real estate supply levels. In any scenario, declines in housing have a negative impact on the economy for several key reasons: They decrease homeowner wealth.

They reduce the number of construction jobs needed to build new homes, which thereby increases unemployment. They reduce property taxes, which limits government resources.

Homeowners are less able to refinance or sell their homes, which may force them into foreclosure. Level of New Business Startups The number of new businesses entering the economy is another indicator of economic health.

Lagging Indicators Unlike leading indicators, lagging indicators shift after the economy changes. Income and Wages If the economy is operating efficiently, earnings should increase regularly to keep up with the average cost of living. Unemployment Rate The unemployment rate is very important and measures the number of people looking for work as a percentage of the total labor force.

Consumer Price Index Inflation The consumer price index CPI reflects the increased cost of living, or inflation. Some key benefits to moderate levels of inflation include: It encourages spending and investing, which can help grow an economy. Otherwise, the value of money held in cash would be simply corroded by inflation.

Leading Indicators - TIMETOTRADE

It keeps interest rates at a moderately high level, which encourages people to invest their money and provide loans to small businesses and entrepreneurs. Interest Rates Interest rates are another important lagging indicator of economic growth. Corporate Profits Strong corporate profits are correlated with a rise in GDP because they reflect an increase in sales and therefore encourage job growth.

Balance of Trade The balance of trade is the net difference between the value of exports and imports and shows whether there is a trade surplus more money coming into the country or a trade deficit more money going out of the country.

Value of Commodity Substitutes to U. Dollar Gold and silver are often viewed as substitutes to the U. Final Word Since the health of the economy is intimately connected to consumer sentiment as can be seen by indicators such as retail sales, politicians prefer to spin data in a positive light or manipulate it such that everything appears rosy.

The State of The Economy: Don't Believe What You Hear On TV. Stock Market Timing Strategies - Do They Really Work? The Best Way to Invest: Fundamental or Technical Analysis? Preventing Identity Theft While Holiday Shopping. JoinSubscribers Sign up below to get the free Money Crashers email newsletter! Read More from Money Crashers Lifestyle Time Banking Explained — How to Trade Services With a Time-Based Currency. Lifestyle 9 Everyday Carry Items You Need to Have to Be Prepared for Anything.

Shopping Spend More for High Quality or Buy Cheap to Save Money? Share this Article Friend's Email Address Your Name Your Email Address Comments Send Email Email sent!