Put option beta

Join the NASDAQ Community today and get free, instant access to portfolios, stock ratings, real-time alerts, and more! We're going to discuss beta today, which is sometimes a difficult concept for options traders to get their arms around. Simply put, beta is a a measure of volatility. Although beta can be calculated in different ways, the beta most people are familiar with is the one that measures a stock's volatility relative to the broad market. A stock with a beta of 1.

Using Beta to Find Great Option Trades - supuwufif.web.fc2.com

Meanwhile, a stock with a beta lower than 1. Beta can also be used to measure the volatility of an individual stock against a specific sector. Beta and volatility are not the same thing. Volatility, as it is used in options trading, is a measure by which the individual stock is expected to fluctuate over a given period of time.

It is the amount by which the underlying stock can change during the life of the option. In options trading, the expected, or implied, volatility, is often measured against actual historic volatility.

This beta is calculated over a period of months and does not necessarily hold true on a daily basis.

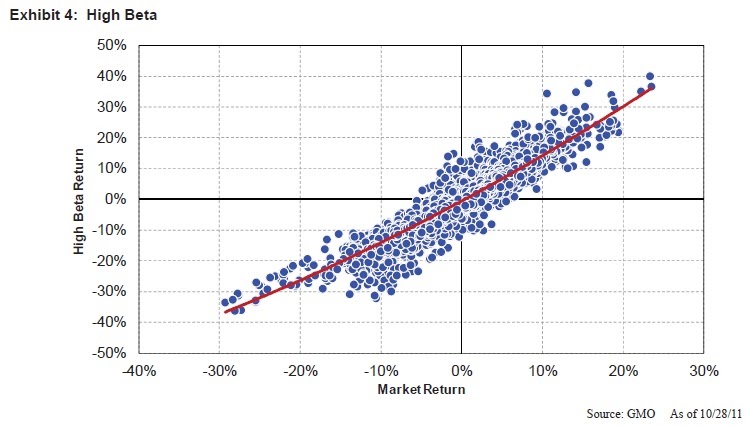

The higher the beta, the more volatile the stock. A beta of less than one indicates that the stock's price is more stable than the market in general and over a long time period. So how is this useful for the average options trader? Simply, a high beta offers the possibility of a higher rate of return, but also poses more risk.

For example, high-tech stocks, as a whole, generally have a higher average beta than 1. If you know that the beta for, say, biotech stocks is 1. So who uses this beta figure and why do they use it?

Portfolio managers and sophisticated traders with large portfolios of stocks use it to hedge their positions. They can either increase or decrease their exposure to the market using the beta calculations. Let's see how this is done using stock futures. With a stock index future, investors can speculate on the general direction of the market or can buy or sell a contract to hedge their positions. It is also possible to buy options on stock index futures. Unlike stock index futures or index options, futures options are settled by delivery of the underlying stock index futures contract, which will later then settle in cash.

Let's say that a fund manger expects the market to rise and he wants to increase his exposure to the market. How can he best achieve this? He can accomplish that by increasing the quantity the dollars invested in the market, or by increasing the beta of the particular portfolio under his control.

The higher the beta, the larger the rise in the value of the portfolio, presuming the market rises as he expects. Schaeffer's Investment Research Inc. Please click here to sign up for free newsletters. Founder Bernie Schaeffer is the author of the groundbreaking book, The Option Advisor: The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Unauthorized reproduction of any SIR publication is strictly prohibited.

Enter up to 25 symbols separated by commas or spaces in the text box below. These symbols will be available during your session for use on applicable pages. You have selected to change your default setting for the Quote Search. This will now be your default target page; unless you change your configuration again, or you delete your cookies.

Are you sure you want to change your settings? Please disable your ad blocker or update your settings to ensure that javascript and cookies are enabled , so that we can continue to provide you with the first-rate market news and data you've come to expect from us.

Company News Market Headlines Market Stream. Economic Calendar Business Video Technology News. How to Invest Investing Basics Broker Comparison Glossary Stocks Mutual Funds. ETFs Forex Forex Broker Comparison. Wealth Management Options Bonds. Retirement Real Estate Banking Insurance. Saving Money Taxes Investments Small Business. Stock Ratings My Ratings Smart Portfolio Overview My Holdings My Portfolio Analysis Crowd Insights My Performance Customize Your Experience. Join Today Already a member?

Beta and Volatility June 24, , This article appears in: More from Schaeffer's Investment Research. FREE Sentiment Magazine FREE Options Newsletter FREE E-newsletters.

Error (Forbidden)

Schaeffer's Investment Research Market News. Most Popular Highest Rated. AMZN Is Up Sharply After Whole Foods Acquisition Snap's share price sinks, trades just above IPO price.

View All Highest Rated. Research Brokers before you trade. Visit our Forex Broker Center. Find a Credit Card Select a credit card product by: Bad Credit Credit Quality Average Credit Quality Excellent Credit Quality Fair Credit Quality Good Limited or No Credit History Personal Loans. American Express American Express Airline Cards American Express Business Cards American Express Cash Back Credit Cards American Express Charge Cards Barclaycard Capital One Capital One Cash Back Capital One Fair Credit Capital One Miles Capital One Points Capital One Prepaid Credit Cards Chase Citi Credit Cards Discover Discover Cashback Discover Miles Discover Student Credit Cards MasterCard Credit Cards U.

Bank USAA USAA Savings Visa Credit Cards. CLOSE X Edit Favorites Enter up to 25 symbols separated by commas or spaces in the text box below. CLOSE X Customize your NASDAQ. CLOSE X Please confirm your selection: Why Alphabet's Waymo Is Leading in Self-Driving Cars Alphabet began its self-driving experiment as early as Update Clear List CLOSE X Customize your NASDAQ.

If, at any time, you are interested in reverting to our default settings, please select Default Setting above. If you have any questions or encounter any issues in changing your default settings, please email isfeedback nasdaq.