Foreign exchange exposure calculation

Exchange rate volatility affects not just multinationals and large corporations, but small and medium-sized enterprises as well, even those who only operate in their home country. While understanding and managing exchange rate risk is a subject of obvious importance to business owners, investors should be familiar with it as well because of the huge impact it can have on their investments. In addition, while transaction and translation exposure can be accurately estimated and therefore hedged, economic exposure is difficult to quantify precisely and as a result is challenging to hedge.

Consider a large U. Their bearish view on the dollar was based on issues such as the recurring U. However, a rapidly improving U. The outlook for the next two years suggests further gains in store for the dollar, as monetary policy in Japan remains very stimulative and the European economy is just emerging out of recession.

Money A2Z

This section assumes some knowledge of basic statistics. The value of a foreign asset or overseas cash flow fluctuates as the exchange rate changes. From your Statistics class, you would know that a regression analysis of the asset value P versus the spot exchange rate S should produce the following regression equation:.

The regression coefficient is defined as the ratio of the covariance between the asset value and the exchange rate, to the variance of the spot rate. Mathematically it is defined as:. USMed is concerned about a potential long-term decline in the euro, and since it wants to maximize the dollar value of its EuroMax stake, would like to estimate its economic exposure.

USMed thinks the possibility of a stronger or weaker euro is even, i. In the strong-euro scenario, the currency would appreciate to 1.

In the weak-euro scenario, the currency would decline to 1. In this example, we have used a possibility of a stronger or weaker euro for the sake of simplicity.

However, different probabilities can also be used, in which case the calculations would be a weighted average of these probabilities. The risks of operating or economic exposure can be alleviated either through operational strategies or currency risk mitigation strategies.

An awareness of the potential impact of economic exposure can help business owners take steps to mitigate this risk. While economic exposure is a risk that is not readily apparent to investors, identifying companies and stocks that have the biggest such exposure can help them make better investment choices during times of heightened exchange rate volatility. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Economic Exposure By Elvis Picardo, CFA Share.

Exchange Rate Risk: Economic Exposure | Investopedia

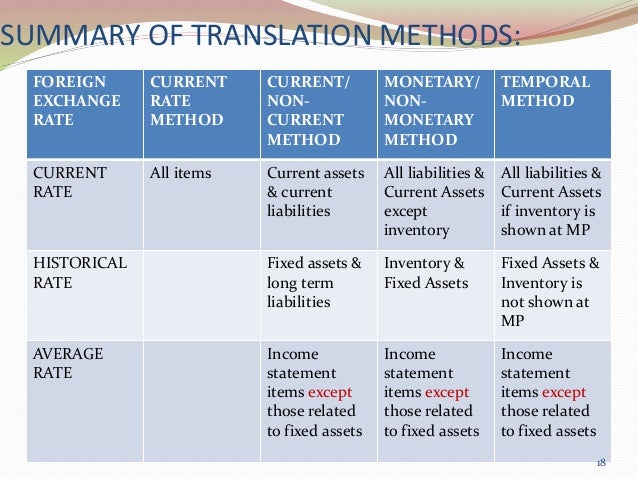

Economic or Operating Exposure Companies are exposed to three types of risk caused by currency volatility: This type of exposure is short-term to medium-term in nature.

This type of exposure is medium-term to long-term. Economic or operating exposure — This is lesser known than the previous two, but is a significant risk nevertheless. For example, a U. Calculating economic exposure Note: From your Statistics class, you would know that a regression analysis of the asset value P versus the spot exchange rate S should produce the following regression equation: Mathematically it is defined as: Are the markets where the company gets its inputs and sells its products competitive or monopolistic?

If both costs and prices are sensitive or not sensitive to currency fluctuations, these effects offset each other and reduce operating exposure. Can the firm adjust its markets, product mix and source of inputs in response to currency fluctuations? Flexibility in this case would indicate lesser operating exposure, while inflexibility would suggest greater operating exposure. Managing operating exposure The risks of operating or economic exposure can be alleviated either through operational strategies or currency risk mitigation strategies.

Operational strategies Diversifying production facilities and markets for products: Diversification would mitigate the risk inherent in having production facilities or sales concentrated in one or two markets.

However, the drawback here is that the company may have to forgo economies of scale. Having alternative sources for key inputs makes strategic sense, in case exchange rate moves make inputs too expensive from one region. Having access to capital markets in several major nations gives a company the flexibility to raise capital in the market with the cheapest cost of funds. Currency risk mitigation strategies The most common strategies in this regard are listed below.

This is a simple concept that requires foreign currency inflows and outflows to be matched. For example, if a U.

This is a contractual arrangement in which the two parties involved in a sales or purchase contract agree to share the risk arising from exchange rate fluctuations. It involves a price adjustment clause, such that the base price of the transaction is adjusted if the rate fluctuates beyond a specified neutral band.

As each company makes a loan in its home currency and receives equivalent collateral in a foreign currency, a back-to-back loan appears as both an asset and a liability on their balance sheets. This is a popular strategy that is similar to a back-to-back loan but does not appear on the balance sheet. In a currency swap, two firms borrow in the markets and currencies where each can get the best rates, and then swap the proceeds.

The Bottom Line An awareness of the potential impact of economic exposure can help business owners take steps to mitigate this risk. The value of your investments is impacted by changes in global currency exchange rates.

Discover the often overlooked risk known as currency risk, and learn three strategies to mitigate or eliminate it in your portfolio. Currency fluctuations are a natural outcome of the floating exchange rate system that is the norm for most major economies. The exchange rate of one currency versus the other is influenced by The wrong currency movement can crush positive portfolio returns. Find out how to hedge against it. Unlike a funded loan, the exposure from a credit derivative is complicated.

Find out everything you need to know about counterparty risk.

Hedging against currency risk can add a level of safety to your offshore investments. Exchange rates have a tremendous influence on the economy. Exchange rates can indirectly affect many of the most important aspects of our lives. Currency risk can be effectively hedged by locking in an exchange rate through the use of currency futures, forwards, options, or exchange-traded funds. In an attempt to dampen down the impact of the stronger dollar, investors have been turning to currency hedged exchange traded funds ETFs in a big way.

Understand constant currency figures, and explore some of the reasons why a company is likely to benefit from reporting using Read about the benefits of engaging in a currency swap, such as when companies in different countries want to borrow funds Exchange rates float freely against one another, which means they are in constant fluctuation.

Currency valuations are determined International currency exchange rates display how much one unit of a currency can be exchanged for another currency. Read about the risks associated with performing a currency swap, including counterparty credit risk in the event that one An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

Global Association of Risk Professionals | GARP

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers.

Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.