Call option risk hedging example

In times of uncertainty and volatility in the market, some investors turn to hedging using puts and calls versus stock to reduce risk. Hedging is even promoted by hedge funds , mutual funds, brokerage firms and some investment advisors. For a primer on options, refer to our Option Basics Tutorial. Hedging with puts and calls can also be done versus employee stock options and restricted stock that may be granted as a substitute for cash compensation. The case for hedging versus employee stock options tends to be stronger than the case for hedging versus stock.

For example, most stock can be sold immediately without any penalties other than capital gains tax if any , whereas employee stock options can never be sold but must be exercised and then the stock sold.

The penalty here is the forfeit of any remaining time premium and an early compensation income tax. However, a higher degree of expertise is required to efficiently hedge the employee stock options, given the lack of standardized exercise prices and expiration dates , tax considerations and other issues. So, as a practical matter, how would an expert efficiently hedge a portfolio of stocks or employee stock options? Understand the Risks and Rewards The first step is to understand the risks of holding the portfolio of stock or employee stock options that you have.

Options, whether exchange traded calls and puts or employee stock options, are certainly more risky to own than stock. There is a greater chance of quickly losing your investment in options compared to stocks, and the risk increases as the option gets closer to expiration or moves further out of the money OTM. Learn more about risks in Reducing Risk With Options.

Next, given your better understanding now of the risks associated with holding the positions that you have, determine how much risk you want to reduce. You may perceive that you are too concentrated in one stock and wish to reduce that risk and avoid paying a capital gains tax or pay the costs of an early exercise of the employee stock options.

Make sure you understand whatever tax rules apply to hedging so that you are not surprised after the event. These tax rules are a bit complicated but sometimes offer attractive results if managed properly. There are special tax rules that apply to hedging employee stock options, and these are different from those that apply to hedging stock. The Process of Trading Be sure that you understand the mechanics of executing the necessary initial trades. How should you enter the trades? Should you enter market orders or limit orders or enter limit orders tied to the stock price?

In my view, you should never enter market orders when trading puts or calls. Limit orders tied to the stock price are the best kind. Next, you should understand the transaction costs and that doesn't just mean the commissions. The spread between the bid and ask and the past volume and open interests should be considered before entering trades. You do not want to enter hedges where there is little or no liquidity when you want to get out. You must also understand the margin requirements associated with the various transactions and how those requirements might change.

Of course, when selling calls one to one against each shares you own, it is simple to determine the margin requirement to make the sale i. Selling more than one to one versus the stock gets a little more complicated but can be handled quite easily. Hedging versus employee stock options will indeed require margin if you have no company stock. Once You're In Next you should understand the required time to monitor the positions as the stock moves around and premiums erode and volatilities and interest rates change.

You may wish from time to time to make adjustments by replacing a set of securities you are using to hedge your portfolio with a different set of securities. Then there are the decisions about whether you should buy puts, sell calls or do a combination of the two.

Finally, decide which calls are the best to sell or which puts are the best ones to buy. For more information on long-term options, see Long-Term Equity Anticipation Securities: When To Take The "LEAP"? When to Buy and Sell One of the most important decisions to make is when you should sell calls and buy puts.

Is the best time to be selling just prior to earnings announcements when the premiums are pumped up or is the week after the earnings are announced the best time to buy puts? And should you consider the implied volatilities of the options hoping to sell overpriced calls and buy underpriced puts?

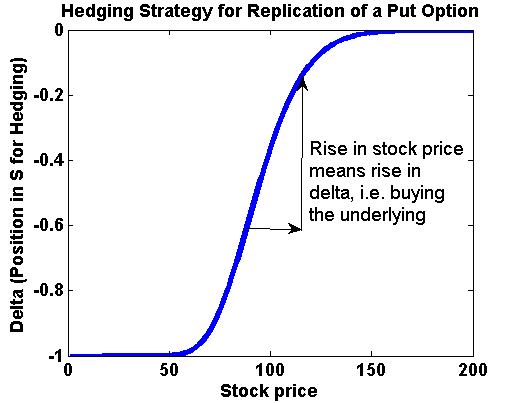

Delta, Gamma, Theta, VegaOften, recently pumped up volatilities imply that something may be in the works and some people are trading on inside information. Perhaps not hedging all the positions at one time is the more prudent approach. Would you sell calls on the day the executives were granted large amounts of options or sell them two or three weeks later?

Do you know how to identify what the executive insiders are doing with the securities of the prospective hedged security?

Hedging financial definition of hedging

There is evidence that when employee stock options and restricted stock are granted to executives, there is a much better chance the stock will increase rather than fall in the following month. The Bottom Line Hedging definitely has its merits, but it has to be well thought out and it is probably best to seek advice from someone experienced in this practice before trying it on your own.

For related reading on hedging, take a look at A Beginner's Guide To Hedging and Practical And Affordable Hedging Strategies. Dictionary Term Of The Day.

Call Option

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Hedging With Puts And Calls By John Olagues Share. This strategy is widely misunderstood, but it's not as complicated as you may think.

Learn how to find and use the most cost-effective ways to transfer risk. Learn how investors use strategies to reduce the impact of negative events on investments.

People hedge as insurance against market volatility. Anyone can do it; here's a primer. Trading options is not easy and should only be done under the guidance of a professional. As long as the underlying stocks are of companies you are happy to own, put selling can be a lucrative strategy. Hedging risk is always a good idea. Here is how sophisticated investors go about it.

We review some options, service providers and processes you can follow while starting up your hedge fund. A thorough understanding of risk is essential in options trading. So is knowing the factors that affect option price. Learn about different hedging strategies to reduce portfolio volatility and risk, including diversification, index options Understand the concept of hedging and learn how this key element to portfolio management can help an investor protect profits Learn about stock options, how to use them to hedge stock positions and how they could help to protect stock portfolios from An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other.

A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.