What happens to in the money option at expiration

English Bahasa Indonesia Home Define Videos Answers Quiz Download Further Reading Beginner Course About Contact. What Are In The Money Options ITM Options?

Options Expiration - How to Manage Expiring Options Positions | InvestorPlace

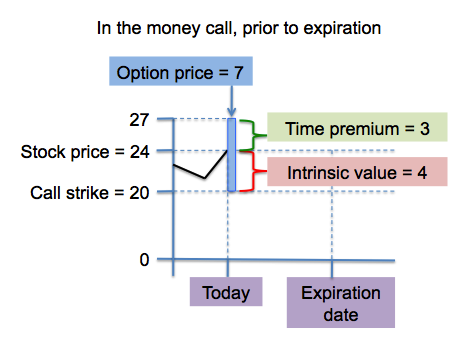

Translate to Chinese Translate to Spanish Translate to French Translate to German Translate to Italian Translate to Portuguese Definition Of In The Money Options ITM Options A stock option which has intrinsic value.

Yes, a stock option is considered to be In The Money ITM if it contains intrinsic valuewhether or not it still has extrinsic value.

In The Money Options ITM Options Introduction In The Money Options ITM Options is one of the three option moneyness states that all option traders has to be familar with before even thinking of actual option trading.

The other two option status are: Out Of The Money OTM options and At The Money ATM options. Understanding how options are priced makes this topic easier to understand.

Any stock option contracts that can be exercised in order to buy its underlying stock for lower than the prevailing market price or to sell its underlying stock for higher than the prevailing market price is said to be In The Money ITM.

In The Money - Learn About 'In The Money' Options

When Is A Call Option In The Money ITM? A what happens to in the money option at expiration option is considered In The Money ITM when the call option's strike price is lower than the prevailing market price of the underlying stock, thus allowing its owner to buy the underlying stock bid ask fx rates lower than the prevailing market price by exercising the call option.

In The Money Option with strike price extremely close to the strike price is also known as " Near The Money Option ". Exercise, Take Delivery, Sell Step 1: Commission Incurred Step 2: Beginner option traders need to remember that every stock options contract represents shares of the underlying stock how to make money fast in runescape non members therefore one would pay times the asking price of a single option contract in order to open a position.

Many beginner option traders think of In The Money Options ITM Options as expensive options because the price consists of intrinsic value as well as premium value while Out of the Money options consists of only premium value and are therefore cheaper.

That is actually a misconception.

The real "cost" of an option is really only the premium value because if the underlying stock does not move, the In The Money Options ITM Options will still be left with its intrinsic value upon expiration while the Out of the Money OTM option would be left worthless. Options involve risk and are not suitable for all investors.

Data and information is provided for informational purposes only, and is not intended for trading purposes. Data is deemed accurate but is not warranted or guaranteed.

The brokerage company you select is solely responsible for its services to you.

Investing Education Center | Ally

By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site. All contents and information presented here in optiontradingpedia. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved.

We Take Our Copyright VERY Seriously! Site Authored by Jason NG aka Mr.