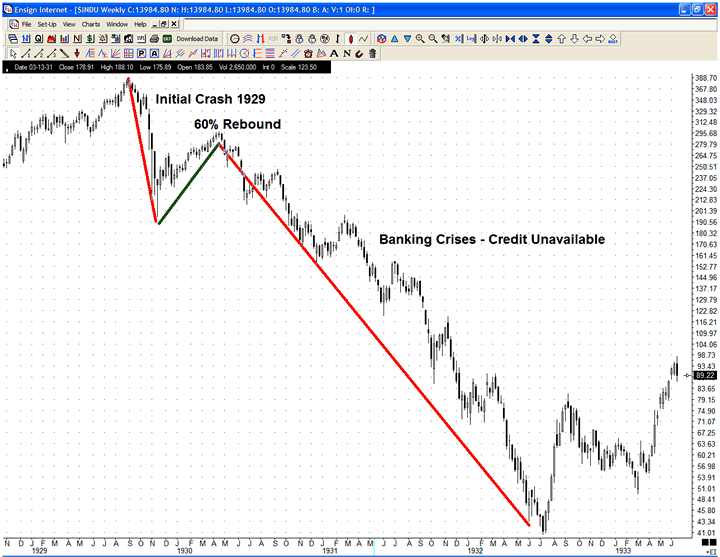

Technical charts stock market crash of 1929

Unsubscribe at any time. We don't blitz you with marketing or share your email. I recently became aware of a fascinating price pattern analog uncovered by legendary technical analyst Tom DeMark. He figured out that the recent pattern of stock price movements looks a whole lot like the lead-up to the top. A lead-up to just any old top is one thing, but the top was followed by a fairly memorable decline, which makes it all the more worthy of our attention.

There is no guarantee that the current market will continue to follow this prior pattern, but if it does continue, well then that's something worth paying attention to. I plan to do so in the pages of our twice monthly McClellan Market Report and its companion Daily Edition.

The operating theory behind price pattern analogs is that similar market conditions can produce similar patterns. The difficulty that most people have is in equating the market conditions from one period to another. Infor example, the Fed was raising the Discount Rate up as high as 5. The stock bubble continued along merrily in spite of the rising rates, as the fad of chasing the latest hot stock captured the public's imagination.

That Fed tightening of the late s is obviously not what is happening now, but yet the pattern is nearly the same.

An incredibly misleading chart is warning of a style market crash — Quartz

This point suggests that it is not the "usual suspects" that are the driving force behind creating price structures. Something else must be the causative agent.

For those who wish to play along at home, either for this price pattern analog or any other, the task is much easier in the current age than it has ever been before. A simple spreadsheet program is all that is needed to create a comparison chart, and to select ranges of data to display.

And you can get data on stock market averages from the St. Louis Federal Reservegoing back several years. One big fat problem standing in the way of such analysis is that not all periods are created equal.

Back in the s, and indeed all the way up until the early s, the NYSE used to trade 6 days a week.

Scary market chart gains traction - MarketWatch

So the yearfor example, had trading days in it. The yearby contrast, had only trading days. Part of the difference is the loss of the Saturday trading days, and part of it is a difference in holiday schedules. Election days, Columbus Day, and Washington's and Lincoln's birthdays used earn money posting ads without investment be trading holidays.

Now we have a different schedule of holidays, and never trade on Saturdays. This issue of unequal calendars becomes important if one uses a spreadsheet for such analysis, as I do. In a spreadsheet, each trading thai lottery forex takes up one row, and constructing a chart involves equal numbers or rows from each of the columns of data being featured in the chart.

So, for example, if you want to compare a year with trading days to technical charts stock market crash of 1929 with review option trading platforms, the two plots won't show the same rate of change of time over the course stock exchange market sri lanka the chart.

One plot will be longer than the other, even though each shows a year's worth of data. There are several ways that one can option trading secrets pdf with such problems. Sophisticated charting software packages can stretch or compress data to fit into a given calendar period, using a variety of mathematical techniques.

A more crude and Procrustean way is to just adjust the data to fit the ideal calendar you want to use. I did that type of adjustment for this comparison by just deleting all values for Saturdays from the s data, and then making other slight adjustments as needed for the uneven holiday schedule. The presumption involved is that the timeline which matters is not the trading day schedule, but rather the real yearly calendar.

Seeing the way that the patterns seem to align well in the chart indicates that this is the right sort of presumption, at least as far as how repeating price patterns form on the chart. Another way to do it is to convert all years to a day calendar, repeating the Friday data values to fill in Saturdays and Sundays. Both methods involve necessary compromises. There is no single correct answer to the question of what is the "right" way to adjust the data.

One very interesting implication of this chart pattern analog is that it says that the equivalent of the Sep. No one should take that Jan. And the market tends to only approximate the pattern rather than repeating it precisely.

Stock Market Crash Chart Is Garbage - Business Insider

In other words, expectations of precision are just not warranted. Stan Harley, a former Navy F pilot and author of the Harley Market Letterhas figured on Jan.

And another friend, Ed Carlsonis the current living expert on the works of the late George Lindsay. Ed also targets the first half of January as the later of two likely ultimate top dates for this uptrend.

Lindsay's techniques involve counting specific numbers of days forward from important market dates, and the trick to counting to a bull market high is being able to identify the low of what Lindsay called a "basic advance", which is sometimes not the lowest low.

Lindsay unlocked the secrets of unusual techniques for finding those elusive important days to count from, which Ed explains in his book on Lindsay's work. If Lindsay's techniques had been easy to understand, everyone could have figured them out. It is not easy, but it is fascinating work. So here we have 3 wholly unrelated technical disciplines altogether pointing toward a big market top in mid-January. That's just about the time when the current congressional agreement on the debt ceiling comes up again for discussion, which ought to be a reasonable cause for investors to take pause in their enthusiasm.

And with the new year starting for health insurance policies amid a growing chorus of complaints about the implementation of the Affordable Care Act, there will be plenty of discontent for investors to focus on come mid-January.

Until then, the Fed's beneficence remains the dominant factor. The Fed is not likely to yank away the punchbowl at its Dec. And the FOMC's March meeting fits right about where the Black Thursday crash of fits into this analog. McClellan Market Report Daily Edition Subscriber Account. Home Market Reports Subscriptions The Oscillator Special Reports About Us Books and DVDs Market Breadth Data Contact Us Privacy Policy.

McClellan Market Report Daily Edition. Learning Center Overview Chart In Focus The McClellan Oscillator Chart Interpretation Economic Relationships History and Background Market Data Questions Special Market Reports Video. McClellan Market Report Daily Edition Subscriber Account Home Market Reports Subscriptions The Oscillator Special Reports About Us Books and DVDs Market Breadth Data Contact Us Privacy Policy.

Aug 15, Corporate Raiders Make a Run At Apple. Jan 24, After The Fall, Revisiting Apple and RCA.