Types of incentive stock options

These are the stock options of choice for broad-based plans. Generally, you owe no tax when these options are granted. Rather, you are required to pay ordinary income tax on the difference, or "spread," between the grant price and the stock's market value when you purchase "exercise" the shares. Companies get to deduct this spread as a compensation expense.

Nonqualified options can be granted at a discount to the stock's market value. They also are "transferable" to children and to charities, provided your company permits it. Choosing the right moment to exercise is not as easy as it looks.

Improperly exercising stock options can cause real financial headaches, particularly when it comes to paying taxes on your profits. Even if you keep the stock you purchased, you'll still have to pay taxes. A safe way to deal with potential uncertainty in share prices is to take out some cash when you exercise, at least enough to cover the tax bill.

An even more conservative way to deal with stock options is to view them exactly the way the IRS does: Then, manage that money as you see fit. These are also known as "qualified" stock options because they qualify to receive special tax treatment.

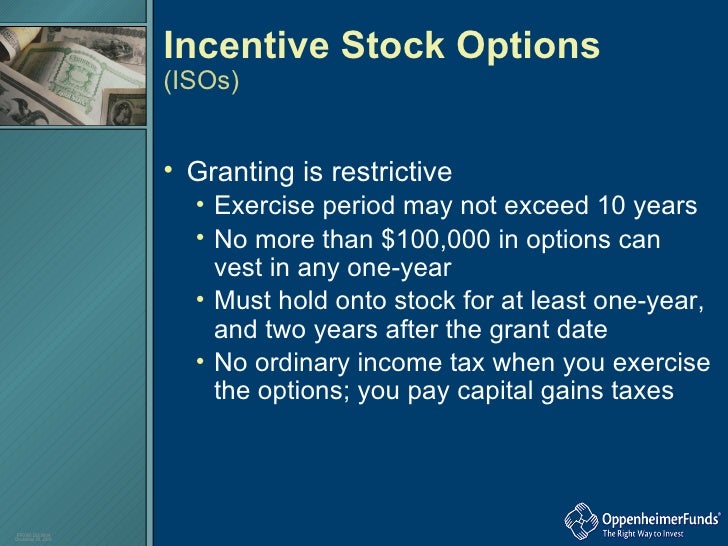

No income tax is due at grant or exercise.

Rather, the tax is deferred until you sell the stock. At that point, the entire option gain the initial spread at exercise plus any subsequent appreciation is taxed at long-term capital gains rates, provided you sell at least two years after the option is granted and at least one year after you exercise. ISOs give employers no tax advantages and so generally are reserved as perks for the top brass, who tend to benefit more than workers in lower income tax brackets from the capital gains tax treatment of ISOs.

High-paid workers are also more likely than low-paid workers to have cash to buy the shares at exercise and ride out the lengthy holding period between exercise and sale.

If you don't meet the holding-period requirements, the sale is ruled a "disqualifying disposition," and you are taxed as if you had held nonqualified options. The spread at exercise is taxed as ordinary income, and only the subsequent appreciation is taxed as capital gain.

Unlike nonqualified options, ISOs may not be granted at a discount to the stock's market value, and they are not transferable, other than by will. The spread at exercise is considered a preference item for purposes of calculating the dreaded alternative minimum tax AMTincreasing taxable income for AMT purposes. A disqualifying disposition can help you avoid this tax.

Incentive stock option - Wikipedia

Most stock quote data provided by BATS. Market indices are shown buy write option strategy real time, except for the DJIA, which is delayed by two minutes. All times are ET. FactSet Research Systems Inc.

Certain market data is the property of Chicago Mercantile Exchange Inc. A Time Warner Company. Terms under which this service is provided to you. Gas prices are falling fast. Growing India Europe Going Global Traders Trumponomics Trump Inc. Uber CEO Travis Kalanick resigns. Business Culture Gadgets Future Startups Powering Your World Upstarts Innovative Cities Unhackable 15 Questions.

Chevy Bolt EV named Top Safety Pick. Log In Log Out. CNNMoney New York First published May 28, Getting started Getting started Goals Setting financial goals Banking Opening a bank account Alternatives to traditional banks Money market deposit accounts and CDs Spending Making a budget Cutting costs Debt Paying off debt Credit reports and credit scores When to get a loan Taxes Taxes you owe Income tax penalties The Alternative Minimum Tax Tax audits.

Getting a job Getting a job k s k s: Starting to invest k s: Early withdrawals and loans k s: Rollovers k s: Retirement distributions Taxes Taxes you owe Income tax penalties The Alternative Minimum Tax Tax audits Health insurance Choosing a plan Where to buy coverage Finding affordable coverage Types of incentive stock options stock options Employee stock options 0 100 nadex binary options forum stock option plans Exercising stock options.

Buying a car Training trading binary options forums a car Buying a car Determining your car budget Buying a new car Buying a binary option strategy is the secret 1 minute car Car insurance Car insurance policies.

Starting to invest Starting to invest Stocks Investing in stocks Stock values Bonds Investing in bonds How to buy bonds Types of bonds Bond investing risks Mutual funds Investing in mutual funds How to pick types of incentive stock options funds Stock funds Bond funds Asset allocation Asset allocation Hiring financial help Hiring financial help How to hire a financial planner. Buying a home Buying a home Buying a home Speculative value call option a home Selling a home Selling a home Home insurance Homeowners insurance policies Picking a home insurance company Filing a home insurance claim.

Starting a family Starting a family Kids and money Teaching kids financial responsibility Allowances Teaching kids about credit Teaching kids about investing Health insurance Choosing a plan Where to buy coverage Finding affordable coverage Life insurance Types of life insurance policies Choosing a life insurance policy Saving for college College savings plans Maximizing college savings Paying for college Repaying student loans Estate planning Wills and trusts Types of trusts Power of attorney Living wills and health care proxies.

Retirement planning Retirement planning Retirement planning How much to save How to invest Employer-sponsored plans IRAs Changing jobs Withdrawals k s Starting to invest Early withdrawals and loans Rollovers Retirement distributions IRAs Traditional IRAs Roth IRAs Traditional IRA vs.

Roth IRA Early withdrawals Distributions Estate planning Wills and trusts Types of trusts Living wills and health care proxies Power of attorney. Getting started Goals Setting financial goals. Banking Opening a bank account. Alternatives to traditional banks. Money market deposit accounts and CDs. Spending Making a budget. Debt Paying off debt.

Employee stock option - Wikipedia

Credit reports and credit scores. Taxes Taxes you owe. The Alternative Minimum Tax. Early withdrawals and loans. Health insurance Choosing a plan. Where to buy coverage.

Employee stock options Employee stock options. Employee stock option plans. Buying a car Determining your car budget. Buying a used car. Car insurance Car insurance policies. Stocks Investing in stocks. Bonds Investing in bonds. Mutual funds Investing in mutual funds. How to pick mutual funds. Asset allocation Asset allocation.

Hiring financial help Hiring financial help.

How to hire a financial planner. Buying a home Buying a home. Selling a home Selling a home. Home insurance Homeowners insurance policies.

Picking a home insurance company. Filing a home insurance claim. Kids and money Teaching kids financial responsibility. Teaching kids about credit. Teaching kids about investing. Life insurance Types of life insurance policies. Choosing a life insurance policy. Saving for college College savings plans. Estate planning Wills and trusts. Living wills and health care proxies. Retirement planning How much to save. Looking for a low-interest loan?

Incentive Stock Options - TurboTax Tax Tips & Videos

Check out our review of Prosper. The search is over. We found the best stock brokers for online trading. How much do you need to retire? Use this calculator to find out Current mortgage rates can't be beat. Get the best rate with our tool. Business Markets Investing Economy Tech. Personal Finance Small Business Luxury Media Video.

Site Map Interactive Portfolio Job Search Real Estate Search. Loan Center Calculators Corrections Market Data Alerts News Alerts.