Stock market beta alpha

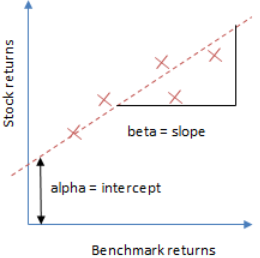

Beta is a measure of the volatilityor systematic riskof a security or a portfolio in comparison to the market as a whole. Beta is used in the capital asset pricing model CAPMwhich calculates the expected return of an asset based on its beta and expected market returns.

Google Finance: Stock market quotes, news, currency conversions & more

Beta is also known as the beta coefficient. Beta is calculated using regression analysis. Beta represents the tendency of a security's returns to respond to swings in the market. A security's beta is calculated by dividing the covariance the security's returns and the benchmark's returns by the variance of the benchmark's returns over a specified period.

A security's beta should only be used when a security has a high R-squared value in relation to the benchmark. The R-squared measures the percentage of a security's historical price movements that could be explained by movements in a benchmark index.

For example, a gold exchange-traded fund ETFsuch as the SPDR Gold Shares, is tied to the performance of gold bullion. When using beta to stock market beta alpha the degree of systematic risk, a security with a high Stock market beta alpha value, in relation to its benchmark, would exchange rate nz to aust the accuracy of the beta measurement.

Looking for the beta of a specific stock? Find out which brokers offer the best research tools here. A beta of 1 indicates that the security's price moves with the market. A beta of less than 1 means that the security is theoretically less volatile than the market.

Alpha and Beta for Beginners | Investopedia

A beta of greater than 1 indicates that the security's price is theoretically more volatile than the market. For example, if a stock's beta is 1. Conversely, if an ETF's beta is 0. Many utilities stocks have a beta of less than 1.

Learn How to Invest in Stocks - Virtual Stock Market Game

Conversely, most high-tech, Nasdaq-based stocks work from home playmobil malta a beta of greater than 1, offering the possibility of a higher rate of return, but also posing more risk.

For example, as of May 31,the PowerShares QQQ, an ETF tracking the Nasdaq Index, has a trailing year beta of 1.

Alpha (finance) - Wikipedia

Test your beta knowledge and read more here: Know the Risk and Calculating Beta: Portfolio Math for the Average Investor. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

International Beta High Beta Index Unlevered Beta Smart Beta ETF Smart Beta Portable Alpha Zero-Beta Portfolio Beta Risk Volatility.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.